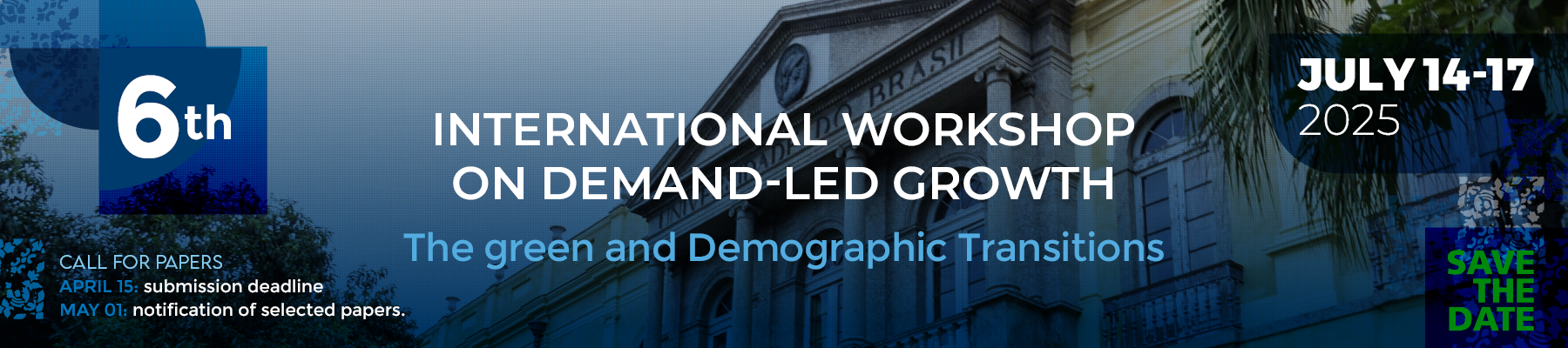

6th INTERNATIONAL WORKSHOP ON DEMAND-LED GROWTH: The green and demographic transitions

July 14-17, 2025

Conference venue:

Arena Copacabana Hotel, at Av. Atlântica 2064, Rio de Janeiro, RJ

Schedule: TBA

Invited Speakers: Aldo Barba (University of Naples Federico II); Sergio Cesaratto (University of Siena); Yeva Nersisyan (Franklin & Marshall College); Carlo D'Ippoliti (Sapienza University of Rome); Antonella Stirati (Roma Tre University); Ariel Dvoskin (UNSAM, CONICET & UNAJ); Matias Vernengo (Bucknell University); Gabriel Porcile (ECLAC); Fabio Freitas (IE-UFRJ); Steven Fazzari (Washington University in St. Louis); Louis-Philippe Rochon (Laurentian University); Luiza Nassif (UNICAMP).

Special Session on Monetary policy and income distribution by research group REMODELA with: Maria Cristina Barbieri Goes (Università degli Studi LINK), Clara Brenck (UFMG), Lídia Brochier (UFRJ), Joana David Avritzer (Connecticut College), Nathalie Marins (UFRJ), Lilian Rolim (Unicamp)

Special Session on Ecological Macroeconomics by the Ecological Macroeconomics Network organized by Guilherme Morlin (University of Pisa); Tiziano Distefano (University of Florence); Patieene Passoni (UFAL)

Special Session on Macroeconomics of Development Banks by Gabriel Aidar (BNDES) and Louis-Philippe Rochon (Laurentian University)

CALL FOR PAPERS

April 15: submission deadline

May 01: notification of selected papers

Recently, sustainable development and the environmental implications of economic development have attracted increasing attention in the economic debate. Particularly in relation to issues such as climate change, resource depletion, renewable energy and loss of biodiversity. There is growing recognition that economic development must address environmental damage in order to achieve long-term sustainability by reducing carbon footprints, promoting renewable energy and the responsible use of natural resources. In response, governments and institutions are increasingly adopting green economic practices. At the same time, there have been major demographic shifts in both advanced and developing countries.

ARTICLES THAT BROADLY FALL WITHIN THE FOLLOWING TOPICS ARE WELCOME:

• Demand-led growth and sustainable development;

• Fiscal policy for the green transition;

• Green finance and the role of central banks;

• Climate change and the analysis of the decarbonization of the economy;

• Input-output analysis of the green transition and structural change;

• Carbon markets and taxation in demand-led growth models

• Demographic transition from a demand-led growth perspective;

• Monetary and fiscal policy, Central Bank, monetary and financial channels in an open economy;

• Demand-led growth, capital flows and external constraints;

• Growth regimes, growth engines, growth models and autonomous demand: debates between post-Keynesians and comparative political economy;

• Conflict inflation, personal and functional income distribution;

• Structuralism, classical political economy and demand-led growth;

• Demand-led growth, theories of stagnation and stagnation policies;

• Demand-led growth, capacity utilization and labor unemployment;

• Demand-led growth and macroeconomic policies;

• Functional finance: implications for monetary and fiscal policies;

• Stock-flow and monetary circuit approaches to money and finance;

• Monetary and financial determinants and constraints of demand-led growth.

Papers should be written in English and contain a title, abstract (maximum 200 words), authors' names, institution and e-mail address. It is recommended that articles have a maximum of 8000 words.

ORGANIZING COMMITTEE:

Guilherme Morlin (University of Pisa)

Gustavo Bhering (UFRJ)

João Vaz (IE/UFRJ)

Letícia Inácio (IE/UFRJ)

Lidia Brochier (UFRJ)

Louis-Philippe Rochon (Laurentian University)

Manuel Valencia (YSI)

Matias Vernengo (Bucknell University)

Nathalie Marins (Boston University)

Nikolas Passos (European University Institute)

Ricardo de Figueiredo Summa (UFRJ)

SCIENTIFIC COMMITTEE

Clara Brenck (UFMG)

Guilherme Haluska (UNILA)

Guilherme Morlin (University of Pisa)

Gustavo Bhering (UFRJ)

Lilian Rolim (Unicamp)

Maria Cristina Barbieri Goes (University of Bergamo)

Nathalie Marins (Boston University)

Ricardo de Figueiredo Summa (UFRJ)

Sylvio Kappes (UFAL)

CONTACT: Este endereço de email está sendo protegido de spambots. Você precisa do JavaScript ativado para vê-lo.